Smart Ways to Invest in Yourself for a Better Future

The most valuable investment you can make is in yourself. Personal growth improves knowledge, skills, and confidence, leading to greater success and well-being. Many people hesitate to spend money on self-development, thinking it’s a luxury, but setting aside funds for learning, health, and personal growth ensures continuous improvement.

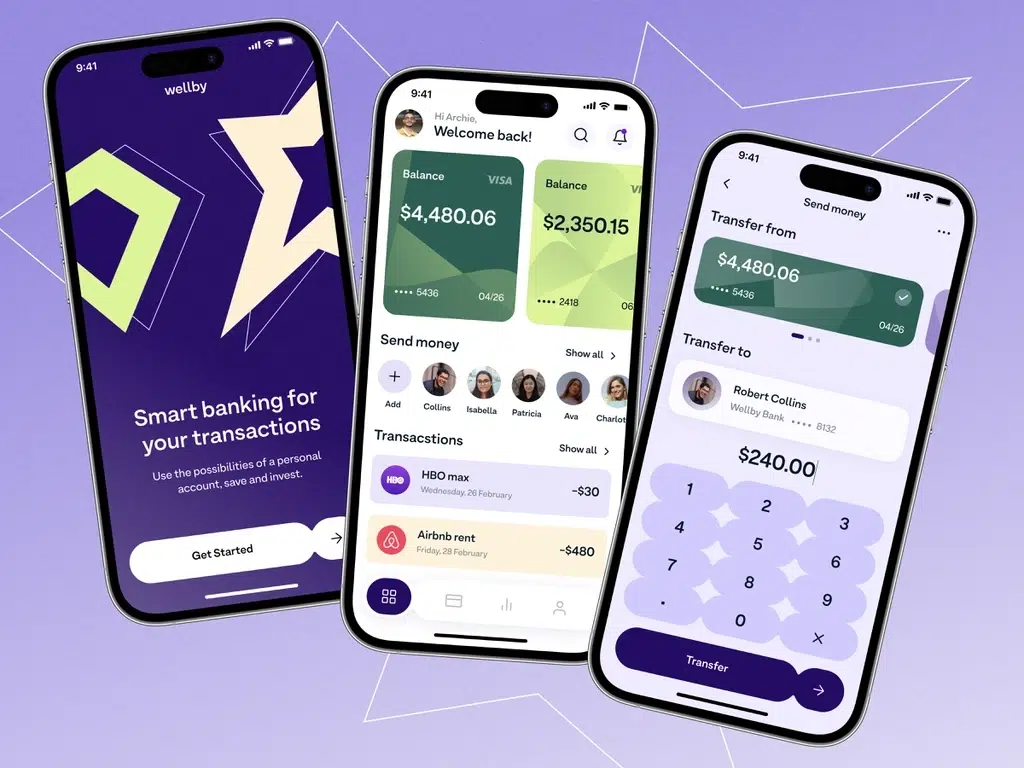

A great way to start is by using the 50-30-20 budgeting rule, where 50% of your income goes to necessities, 30% to personal development and lifestyle, and 20% to savings and investments. You can also create a self-improvement fund to cover courses, books, coaching, and other growth-related expenses. Financial apps can help automate savings for self-investment, making it easier to stay committed.

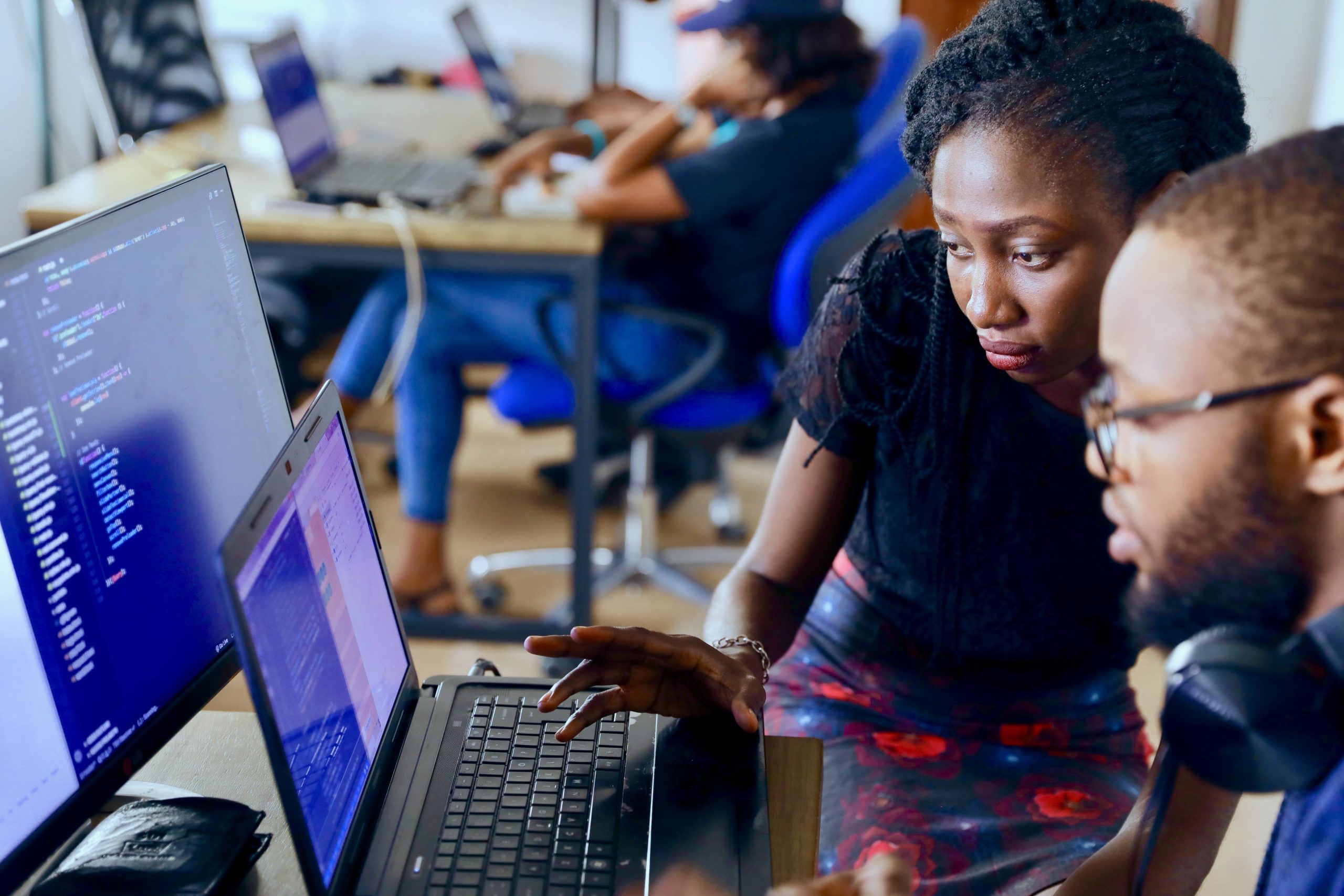

Lifelong learning is key to staying relevant. Investing in courses, workshops, and professional certifications improves career prospects. Platforms like Coursera, Udemy, and LinkedIn Learning offer affordable options. Reading is another cost-effective way to gain knowledge. Setting aside a small monthly budget for books, e-books, or audiobooks ensures continuous learning. Podcasts also provide valuable insights from experts and can be incorporated into daily routines.

Coaching and mentorship offer guidance for personal and professional growth. While hiring a coach can be costly, planning for it in advance or using payment plans makes it more accessible. Personal grooming and appearance also play a role in confidence and success. Allocating a budget for quality clothing, skincare, and self-care ensures a polished and professional image.

Physical and mental well-being should never be overlooked. Investing in fitness programs, gym memberships, or workout equipment improves health and productivity. Mental health support, such as therapy or meditation apps, helps manage stress and build resilience. Setting aside funds for relaxation, vacations, or self-care activities prevents burnout and promotes work-life balance.

Networking is another crucial investment. Attending conferences, business events, or professional meetups expands career opportunities. If large events are too costly, online networking groups and virtual conferences offer alternatives. Financial literacy is also essential for long-term success. Taking financial education courses, hiring an advisor, or following personal finance experts helps develop smart money habits.

Building wealth requires smart money management. Instead of keeping savings idle, investing in stocks, bonds, real estate, or mutual funds helps grow financial security. A self-improvement fund can support courses on investing, stock markets, or real estate training, ensuring better financial decisions.

Experiencing new things also contributes to personal development. Setting aside money for travel, cultural activities, or new hobbies fosters creativity and adaptability. Investing in rest is equally important—planning for vacations, relaxation activities, or wellness retreats helps maintain energy and motivation.

To make self-investment easier, automate savings through budgeting apps or financial tools. A dedicated self-improvement fund ensures that personal growth remains a priority. Using extra income or work bonuses for education and skill-building can accelerate progress. Planning and prioritizing investments prevent financial strain, making personal development sustainable.

Financial literacy expert Sola Adesakin emphasizes that personal growth is essential for wealth creation. She explains that money can only grow when the person managing it also grows. Forbes also highlights that embracing challenges and learning from setbacks leads to progress.

Investing in yourself leads to long-term success in all areas of life. Whether through education, networking, health, or new experiences, continuous self-improvement builds a stronger, more fulfilling future.