How to Grow Your Money Using Your Bank’s Mobile App

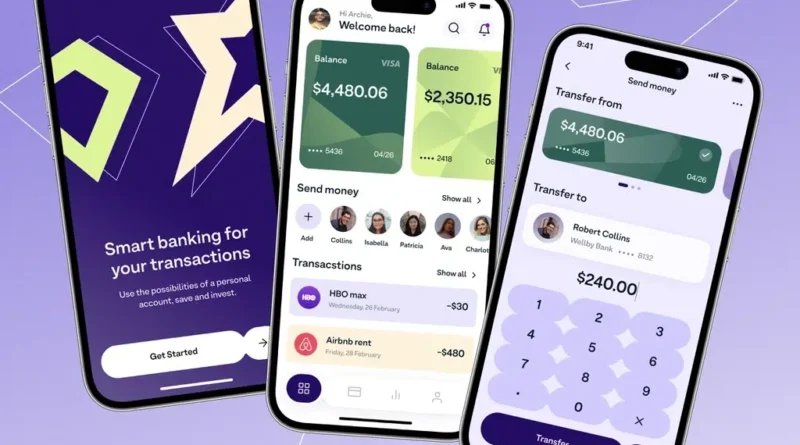

In today’s digital era, your bank’s mobile app is more than just a tool for sending and receiving money—it’s a gateway to smarter financial growth. Many Nigerians are now discovering how banking apps can help them save automatically, invest wisely, track expenses, access loans responsibly, and even earn rewards. With these features, financial discipline and wealth-building are now easier and more accessible to everyone.

A good starting point is automated savings. Instead of trying to remember to save, most Nigerian banks now offer automatic deductions through their mobile apps. You can set a fixed amount, like ₦2,000 weekly, to move from your main account into a savings account. Banks such as Sterling Bank through its Go Money app and Wema Bank via ALAT allow customers to set specific goals, like saving for rent or school fees, while tracking progress and earning higher interest. This approach not only helps you build discipline but also ensures consistent savings growth.

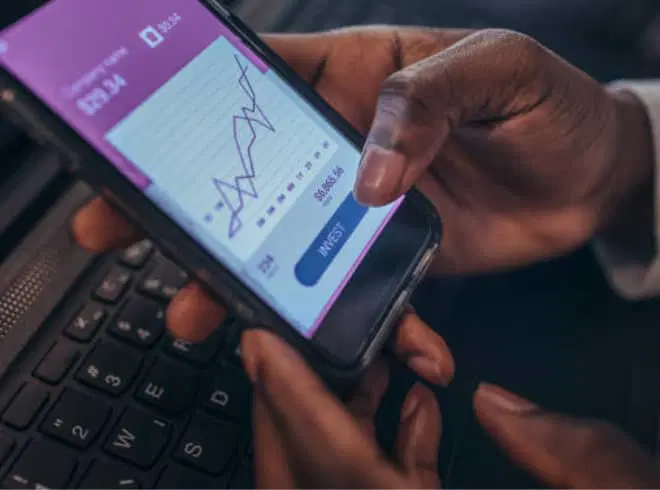

Banking apps also provide direct access to investment opportunities once reserved for the wealthy. Through apps like GTBank’s Habari and Stanbic IBTC’s Mobile App, users can invest in mutual funds, fixed deposits, or government bonds with just a few taps. These digital platforms allow even small investors to start earning returns and benefit from the power of compounding, where interest grows over time on both your initial investment and accumulated earnings.

Expense tracking is another major advantage. Many Nigerians struggle to know where their money goes each month. Apps from banks like Access Bank, GTBank, and Zenith Bank now feature dashboards that automatically categorize your spending—showing how much goes into food, data, or transportation. These visual tools help you identify unnecessary expenses, set budgets, and build healthier money habits. By understanding your spending patterns, you gain better control and can channel more funds into savings or investments.

Mobile banking apps have also simplified access to quick digital loans. With products like GTBank’s QuickCredit, Access Bank’s PayDay Loan, and Sterling’s Specta, customers can borrow instantly without visiting a branch. However, experts advise using these loans responsibly—only for emergencies or income-generating ventures. Late repayment can attract penalties and damage your credit score, while responsible borrowing strengthens your credit profile and opens doors to larger loans in the future.

Another overlooked feature is the reward system many banks now offer. Customers earn cashback, loyalty points, or bonus interest rates for paying bills, making transfers, or saving through their mobile apps. Though the amounts might seem small, consistent usage can add up to real value over time. Beyond financial rewards, using your app also saves you time and helps avoid the stress of long bank queues.

The key to financial growth through your banking app lies in using it intentionally. Instead of checking balances or making random transfers, think of each feature as a tool to strengthen your financial position. Automate your savings, explore low-risk investments, monitor expenses, borrow smartly, and take advantage of digital rewards.

Ultimately, your phone can become your most powerful financial assistant. You don’t need to be wealthy to start; consistent small actions create meaningful growth. Whether you’re planning for rent, school fees, or retirement, your bank’s app provides the structure and convenience needed to stay accountable and grow your wealth.

The future of financial independence is already in your hands—literally. Every transaction through your banking app can bring you one step closer to the financial stability you’ve always wanted. Think beyond checking balances; think growth, consistency, and smart money management.